Introduction of Basel Accords

Basel History

Basel Committee

Basel committee’s full name is Committee on Banking Regulations and Supervisory Practices. It was established by the central bank Governors of the Group of 10 countries at the end of 1974.

Right now it has expanded to 45 institutions from 28 countries.

The Goal of this committee is: (i) no banking establishment would escape supervision; and (ii) supervision would be adequate and consistent across member jurisdictions.

Basel I: the Basel Capital Accord (1988)

- Set up minimum regulatory capital requirements to ensure banks are able, at ll times, to give back depositor’s funds.

The 1988 Accord called for a minimum ratio of capital to risk-weighted assets of 8% to be implemented by the end of 1992, i.e.,

Basel II: the new capital framework (2004)

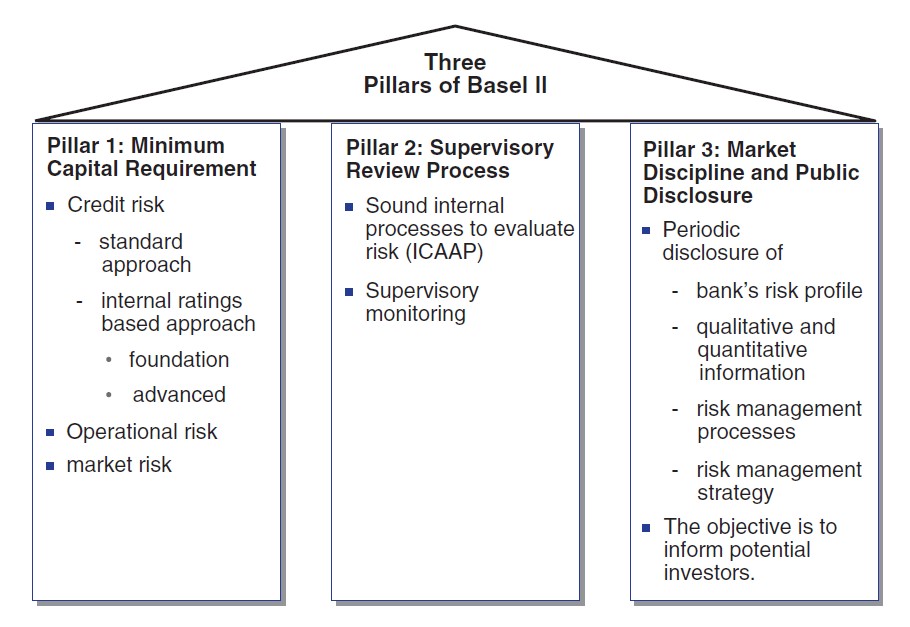

In June 2004, the committee released a revised capital framework, generally known as “Basel II”, which comprised three pillars:

capital requirements, which sought to develop and expand the standardised rules set out in the 1988 Accord

supervisory review of an institution’s capital adequacy and internal assessment process

effective use of disclosure as a lever to strengthen market discipline and encourage sound banking practices

The new framework was designed to improve the way regulatory capital requirements reflect underlying risks and to better address the financial innovation that had occurred in recent years. The changes aimed at rewarding and encouraging continued improvements in risk measurement and control.

Basel III: responding to the 2007-09 financial crisis

The banking sector entered the financial crisis with too much leverage and inadequate liquidity buffers. These weaknesses were accompanied by poor governance and risk management, as well as inappropriate incentive structures. The dangerous combination of these factors was demonstrated by the mispricing of credit and liquidity risks, and excess credit growth.

The enhanced Basel framework revises and strengthens the three pillars established by Basel II, and extends it in several areas.

Most of the reforms are being phased in between 2013 and 2019:

stricter requirements for the quality and quantity of regulatory capital, in particular reinforcing the central role of common equity

an additional layer of common equity - the capital conservation buffer - that, when breached, restricts payouts to help meet the minimum common equity requirement

a countercyclical capital buffer, which places restrictions on participation by banks in system-wide credit booms with the aim of reducing their losses in credit busts

a leverage ratio - a minimum amount of loss-absorbing capital relative to all of a bank’s assets and off-balance sheet exposures regardless of risk weighting

liquidity requirements - a minimum liquidity ratio, the Liquidity Coverage Ratio (LCR), intended to provide enough cash to cover funding needs over a 30-day period of stress; and a longer-term ratio, the Net Stable Funding Ratio (NSFR), intended to address maturity mismatches over the entire balance sheet

additional requirements for systemically important banks, including additional loss absorbency and strengthened arrangements for cross-border supervision and resolution

Implementation

When implementing Basel Accord, each country has their own modification version. For example, After the final set of Basel III reforms (“final Basel III reforms”) published in December 2017, Canadian financial regulator: The Office of the Superintendent of Financial Institutions (OSFI) proposes to make some modifications to the final Basel III reforms for implementation in Canada. Implementation of the final Basel III reforms in Canada